Balance transfer Q&A: “What is a high interest rate for a credit card?”

Without high interest rates, credit card balance transfers simply wouldn’t exist. Indeed, it is because credit card APR is so high that balance transfers are offered in the first place.

The main reason you’ll apply for a balance transfer is to lower your credit card’s interest rate, so you may be wondering if your rate is high enough to justify a move.

Well, the answer may be subjective depending on what you feel is a fair interest rate to pay, but with so many 0% balance transfer offers available, one could argue that any rate above 0% is too high.

When it comes down to it, interest rates on credit cards are some of the highest rates out there, and the CARD Act didn’t impose a maximum credit card rate. In other words, credit card companies are generally free to charge whatever rate they choose.

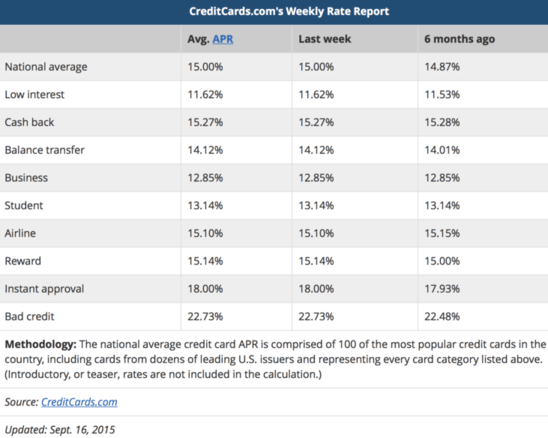

National Average Credit Card Rate Is 15%

As you can see from this chart from CreditCards.com, the national credit card rate is a not-so-low 15% APR. Clearly that’s high, but it’s also the average.

In other words, credit card rates are high by default, so “low interest” credit cards really aren’t that cheap. They’re just lower relative to the standard credit card’s APR.

Personally I don’t think a rate of 11.62% is low. In fact, I would define it as high, even if it’s lower than average.

For me, a rate of 5% or lower is a good credit card rate, and 0% is clearly optimal if you can snag it for a decent amount of time to pay off your debts.

Sorry, 10% Is Not a Low Credit Card Rate

While scouring credit card offers online, which I do frequently to come up with my massive list of no fee balance transfers, I often see things like “a low rate of 10%,” or a “great rate set at 9%.”

Ultimately, these aren’t really great rates. In fact, they’re pretty high if you compare them to any other interest rate out there. They’re just lower than what you might be paying elsewhere, which is why these banks and credit unions can refer to them as “low” or “great” to begin with.

If you want a truly great credit card rate, look for either a 0% balance transfer or a no fee balance transfer that offers a rate of 5% or less. It really isn’t that hard to come across these types of offers, so there’s no reason you should pay anything more.

We Are Ignorant on Credit Card Rates

My guess is that banks rely on our ignorance when it comes to what a good credit card rate really is. They assume we don’t know what low should be, and any amount of improvement will generally be met with little resistance.

This allows them to offer rates of 10%, knowing it’s better than the 15% or 20% rate you’re currently paying. And hey, they’re right. It is lower, sometimes even 50% lower, but that doesn’t mean it’s still not high.

Sure, better is better, and lower is in fact lower, but it may not be the best out there, or even close to it.

If you aim for the lowest rate possible, zero, you won’t have to wonder if you can do any better. Your low rate will also allow you pay down your credit card balances as quickly as possible because more, if not all, of your monthly payment(s) will go toward the principal balance, as opposed to interest.