Balance transfer Q&A: “What is a balance transfer check?”

Credit card balance transfers are great tools to pay off debt, but sometimes you may need cash to pay off something other than another credit card. Or simply need the money today as opposed to a week from now.

Fortunately, there is a simple solution. Similar to credit card balance transfers are “balance transfer checks,” which offer a lot more flexibility than the former.

Can I Write a Balance Transfer Check to Myself?

- Balance transfer checks provide the same flexibility as normal checks

- You can make them out to yourself, another person/business, or to CASH

- Just note that the balance must be paid back just like a credit card

- It’s not free money, it’s a loan that may accrue interest depending on the associated terms

In a nutshell, a balance transfer check is just like any other check in that you can deposit it into your bank account, make it out to someone else, or simply get cash with it.

The difference is that the amount you write on that check becomes the outstanding balance on the associated credit card account since you aren’t drawing it from your own checking or savings account.

It’s not free money, nor is it your own money. It’s a loan.

For example, if you make out a balance transfer check to yourself for $1,000, you’ll have $1,000 in your bank account (or in hand), but you’ll also have a $1,000 credit card balance. Get it?

You can then use this money to buy stuff, pay off bills, pay someone back, or do whatever else you’d like. After all, it’s money.

The hitch is that you have to pay the $1,000 back at some point, as you would any other credit card debt.

The good news is these offers typically come with 0% APR, meaning you won’t be on the hook for any interest for X amount of time, usually 12 months or longer.

However, standard balance transfer fees usually apply, so keep that in mind before you proceed.

Balance Transfer Checks Typically Wind Up in Your Mailbox

Wondering where to get one of these majestic pieces of paper?

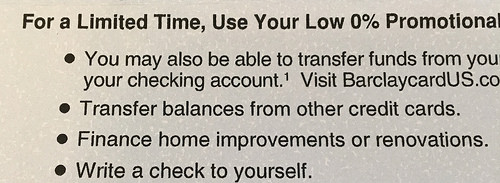

Well, balance transfer checks tend to be delivered by mail in the form of an unsolicited offer, or can sometimes be requested online at your credit card issuer’s website.

Your existing credit card issuers love to send them out because they want your debt! They sometimes refer to them as “convenience checks.”

They’re essentially blank checks (that you can fill in just like a normal check) up to your credit limit, less fees, which can be used for really any purpose.

As noted, you could make the balance transfer check out to yourself and deposit the money into your checking or savings account. It could then be used to pay for anything you please, whether it’s a bill or an unrelated purchase.

If the associated offer is a 0% APR balance transfer, or better yet a no fee balance transfer, you could get your hands on some cash at no cost to you (enter balance transfer arbitrage).

Of course, you wouldn’t want to spend that cash unless you knew you could pay it back before the 0% APR period expired. Heck, who wants to pay credit card finance charges?

You could also use a balance transfer check to pay off another person’s credit card balance, such as a spouse or family member with bad credit.

This can be really beneficial if they can’t get approved for a balance transfer credit card, and you trust them enough to pay you back. Just be careful, because you’ll ultimately be on the hook for any checks you cash.

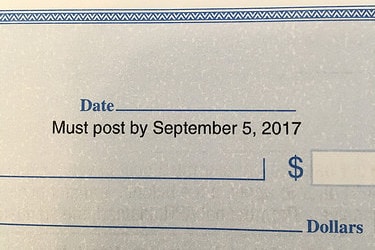

Tip: Balance transfer checks have an expiration date, or certain date when they must post to your account in order to qualify for the promotional APR. Otherwise the much higher standard APR will apply, so don’t waste time cashing them!

In fact, some issuers say they’ll honor the checks after the “use by date,” but standard purchase APR and balance transfer fees will apply!

In other words, they’re happy to give you a bad deal if you wait too long to take advantage of the good deal.

Balance Transfer Checks vs. Balance Transfer Credit Cards

The biggest difference between the two is that a balance transfer check can be converted into cash, a big plus for anyone who wants cash at a low interest rate or even at 0% APR.

Conversely, a standard balance transfer offer will usually only allow you to pay off other existing balances, namely other credit card balances and maybe some other types of loans.

So really standard credit card balance transfers are only good for those with existing credit card debt.

Just be sure to understand that balance transfer checks, like ordinary credit card balance transfers, come with terms and conditions that must be adhered to, such as minimum payment requirements, and may also be subject to finance charges, so take caution and read the fine print, twice!

They’re certainly not free money, and must be paid back!!! Don’t just go cashing them willy-nilly because they must be paid off just like a credit card.

In my experience, Citi and Chase seem to be the biggest issuers of balance transfer checks, though Barclaycard has come through with some really good offers lately that offer 0% APR and only a 1% balance transfer fee!

Wells Fargo also sends out so-called “SUPERCHECKS” a lot, their version of balance transfer checks that just have a catchy name. They don’t differ otherwise. Each issuer may refer to them differently, but it’s just marketing.

Tip: Don’t confuse balance transfer checks with cash advances, which often come with sky-high APR and costly fees at the outset. They are entirely different!