If you’re searching for current balance transfer offers from American Express, you’re on the right page. They disappeared for a while after the credit crunch, but they’re now back in full force so check them out below.

American Express Balance Transfer Offers:

Amex EveryDay® Credit Card – 0% intro APR on purchases and balance transfers for 15 months if made in first 60 days. No fee!!

Amex EveryDay® Preferred Credit Card – 0% intro APR on purchases and balance transfers for 15 months. Greater of $5 or 3% of the amount of each transfer.

Blue Cash Everyday® Card from American Express – 0% intro APR on purchases and balance transfers for 15 months. Greater of $5 or 3% of the amount of each transfer.

Blue Cash Preferred® Card from American Express – 0% intro APR on purchases and balance transfers for 15 months. Greater of $5 or 3% of the amount of each transfer.

These are the best and only balance transfer offers from American Express currently.

Be sure to check in often as the offers change frequently, and anything that comes up will be posted here promptly.

Does American Express Do Balance Transfers Anymore?

Yes. Much like any other credit card issuer, American Express typically has balance transfer offers available, though they’ve slowed down in recent years.

American Express recently did away with most of their balance transfer credit cards as a result of the ongoing credit crunch and they’ve never offered no fee balance offers to my knowledge.

In the past, they offered 0% balance transfers and other promos like balance transfers for the life of the balance, just like the other major credit card issuers.

But they seemed to have lost their risk appetite for such offers, despite other credit card issuers getting back into it.

Of course, it’s only a matter of time before American Express re-introduces their balance transfer offers, so be sure to visit this page in the near future.

For the record, American Express does offer some 0% APR credit cards, but that promotional rate usually only applies to purchases, not balance transfers. Be sure to check that both are covered to avoid unnecessary finance charges.

Existing Customers Should Check Their Website For Offers

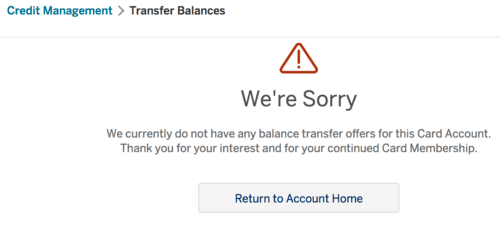

If you’re already an American Express cardholder, you can log-on to their website to view available balance transfer offers for existing customers. Go to Account Services, then click on “Transfer Balances.”

Even if it says there aren’t any balance transfer offers currently available, you’ll probably still be able to execute a balance transfer with American Express, assuming your credit is up to snuff.

You can either call American Express and inquire about balance transfer offers that may not be listed on their website, or simply shop around online for offers.

I didn’t have any offers on either of my Amex cards, so I could call in or do an online chat to see if they’ve got anything that’s not listed for whatever reason.

Generally, their Blue series of credit cards offer the best balance transfer deals.

If you have an existing balance on a credit card with a different issuer (e.g. Bank of America, Capital One, Citi, Chase, Discover, HSBC), you may be able to open a new 0% balance transfer credit card with American Express, or a low fixed rate for the life of the balance transfer, and move that balance to the new Amex.

If you have an existing balance on an American Express credit card, and you’d like to transfer the balance, you can open a new balance transfer credit card with another card issuer or transfer the balance to an existing credit card with a different issuer.

Keep in mind that like all other credit card issuers, American Express will not allow you to transfer one American Express credit card balance to another American Express credit card.

Balance transfers only work when they involve two different companies. For example, you can move your Citi credit card balance to an American Express credit card, and vice versa.

American Express Balance Transfer FAQ

Like most other issuers, American Express tends to charge 3% of the balance transferred, or $30 for every $1,000 moved to Amex. However, fees can certainly range, so read the fine print!

Additionally, some American Express cards only allow you to transfer up to 75% of the credit limit on the balance transfer card. And the maximum dollar amount of all transfers can’t exceed $7,500!

For example, if you got approved for a new Amex with a $10,000 credit limit, you’d only be able to move a total of $7,500. Why they want that pretty large buffer is unknown. But if you exceed this percentage your balance transfer request could be denied.

It’s unclear if that number includes the balance transfer fee, which could further limit how much you can move.

Another important detail is that American Express balance transfers can take as long as six weeks to process, so be extra careful in making minimum payments on any old credit cards you’re paying off with Amex. However, they’re usually processed within 5-7 days.

Lastly, note that you must request the balance transfer within 60 days of account opening in order to get approved and any accounts being paid off must be in your name. That means time is of the essence and you probably won’t be able to pay off a spouse’s credit card.

Tip: The good news is that American Express tends to be very customer friendly, so if you have concerns, call them up, and don’t forget to ask them to waive the balance transfer fee!

Looks like Amex isn’t the place to go for a balance transfer…probably better to run a balance up with them first, then transfer to another issuer.